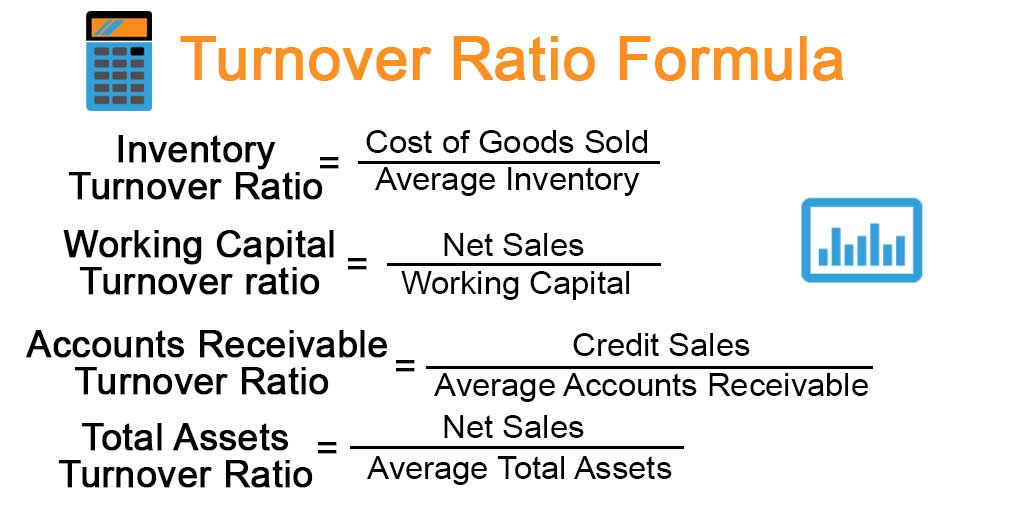

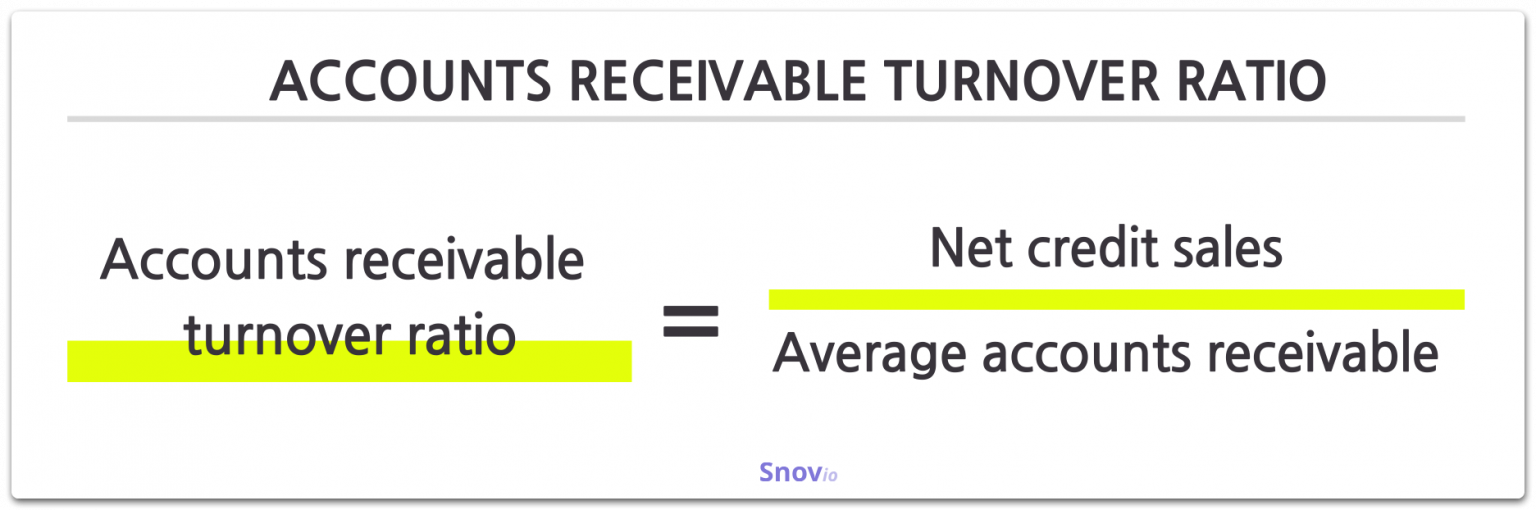

While a low ratio implies the company is not making the timely collection of credit.Ī good accounts receivable turnover depends on how quickly a business recovers its dues or, in simple terms how high or low the turnover ratio is. R e c e i v a b l e T u r n o v e r R a t i o = N e t r e c e i v a b l e s a l e s A v e r a g e n e t r e c e i v a b l e s Ī high ratio implies either that a company operates on a cash basis or that its extension of credit and collection of accounts receivable is efficient. The receivables turnover ratio is an activity ratio, measuring how efficiently a firm uses its assets.

Let's go ahead and jump into some practice problems.Receivable Turnover Ratio or Debtor's Turnover Ratio is an accounting measure used to measure how effective a company is in extending credit as well as collecting debts. So in general this is a pretty easy formula.

Well it implies you pay off your debts more quickly right? You're able to pay them off more quickly as the as the ratio goes higher. And last but not least I want to just mention here that a higher ap turnover the higher your ap turnover.

Right? So how do we compare ap turnover? Well like most ratios we use benchmarking right? Because we have to know in our industry what's a reasonable amount? So we check with our competitors, we check with the industry average and we see how our ap turnover compares to them. Right? Because we're gonna have to be paying off those ap and keep them at some average balance that we have for our company. So you can imagine that numerator is gonna be bigger than the denominator. Accounts Payable Turnover Ratio is a short-term liquidity measure used to quantify the rate at which a company pays off its suppliers. Right? So we're gonna have some average balance but those purchases keep increasing as we purchase and purchase. So if you think about it right we're gonna have some accounts payable balance and every time we purchase it's gonna increase that balance but it's not just gonna keep increasing and increasing. The ap turnover it tells us how many times we're able to pay our ap during the year, how many times we are able to pay ar ap during the year. Specifically, your payable turnover ratio measures the number of times you pay out your average AP balance over a given time period. So how do we analyze an ap turnover? Well the ap turnover, let me leave it on the screen there. You're just gonna have a cogs amount divided by average Ap easy peasy. But like I said you're generally not gonna do that. So we could get purchases for our numerator with that amount of information.

ACCOUNTS PAYABLE TURNOVER RATIO PLUS

So if we rearrange those algebraic lee and solve for purchase is what we're going to see that it equals the cogs plus the ending inventory minus beginning inventory. Cogs is gonna lower the account will be left with an ending balance. And then what's gonna lower the inventory account? Well when we sell inventory right. Account right? We're gonna have some beginning balances a debit and then we're gonna have purchases, we're gonna buy more inventory. It is an indicator that quantifies how quickly a company pays its suppliers. Well we can back into our purchases or get a pretty good estimate of it. The accounts payable turnover ratio is a short-term liquidity accounting ratio. So if we see a balance sheet and we're given two years if we're given last year's balance sheet this year's balance sheet and we have an income statement. We can back into it if we're giving a begin if we're given an inventory account. Okay so we've got an interesting way to calculate our purchases. Beginning balance plus ending balance divided by two. Uh Because it's a little less complicated and we're gonna divide that by our average Ap so remember every time we do an average it's gonna be the beginning balance plus the ending balance divided by two. Um But generally like I said you're gonna we're gonna use cogs in this class. See how he generally how he generally uh tackles these questions. The accounts payable turnover ratio, or payables turnover, quantifies the rate a company pays its suppliers during a given period. You're gonna want to check with your professor, see his questions. How efficiently are we, how efficient are we at paying off our debts, paying off our accounts payable? Okay so the account payable turnover notice in this, in the formula here I've got purchases or cogs in the numerator. Okay that's the accounts payable turnover and this is a common efficiency ratio. And we're gonna relate that to our average accounts payable level. But we're gonna go with cogs is generally what we're gonna use here. But the technically correct term is purchases. Well this is going to relate the amount of generally I'm gonna say cogs most of the time in your class you're gonna use cogs as the numerator.

0 kommentar(er)

0 kommentar(er)